.jpg&w=1200&q=75)

Monthly Recurring Revenue more commonly known as MRR is a business metric most widely used in subscription businesses where a portion of your revenue stream is predictable and recurring such as Software as a Service (SaaS). It's one of the most if not the most important metrics in any subscription business.

In this article, we will elaborate on the previous article on how to calculate MRR with a concrete example using SQL and data from Stripe. Even though this article is centered around Stripe you can also get a lot of inspiration if you are using other payment processors software like GoCardless, Adyen, or Square or billing software like Xero, Zoho, or Freshbooks.

This guide assumes that you already have your Stripe ready to analyze in your data warehouse. If not check out this article to learn more about how to extract data from Stripe.

Now follow this step-by-step guide using Weld to create an MRR model using Stripe data with SQL.

Step 1: Get all subscriptions

To begin, it is essential to define MRR from a Stripe perspective with a clear formula. MRR is calculated using this equation:

MRR = sum of recurring revenue from active subscriptions

In other words, we need to find all the active subscriptions and then calculate the total revenue on a monthly basis. Since subscriptions can change over time, let's use this query to get all subscriptions from Stripe.

Tip: Replace or adjust the table names based on your setup.

1select

2 id

3 , customer_id

4 , start_date

5 , canceled_at

6 , id subscription_id

7 , status

8from

9 {{raw.stripe.subscription}}

Step 2: Get subscription plans

The next step is to join the subscription plans which hold information about what plan each subscriber is on. To do this you also need to left join the subscription_item table which holds the price_id. Then you can use the price_id to join the plan as shown below. We need to divide by 100 because the Stripe API returns two additional zeros for all amounts.

Tip: It is important to set up a new subscription whenever changes occur, in order to capture historical data. Otherwise, your model won't be functional. Additionally, you can ensure that your data warehouse's tables incorporate Slowly Changing Dimensions (SCD), so as to store past data. Make certain to use the right filtering methods to prevent any double counting of subscriptions.

Moreover, we join in the coupon and subscription_discount tables in order to calculate any discounts applied to the subscription. You will also note that we do a case when statement to assess whether the start_date equals cancelled_at to avoid duplicates from new subscriptions created but canceled in the same month. Ideally, any subscription is set up correctly from the beginning but mistakes happen.

1select

2 s.id

3 , s.customer_id

4 , s.start_date

5 , s.canceled_at

6 , s.id subscription_id

7 , s.status

8 , d.coupon_id

9 , c.amount_off / 100 amount_off

10 , si.price_id

11 , si.quantity

12 , p.amount / 100 amount

13 , p.interval_count

14 , p.interval interval_period

15 , p.currency

16 , case

17 when date_trunc(start_date, month) <> date_trunc(canceled_at, month) then 0

18 when canceled_at is null then 0

19 else 1

20 end deleted

21from

22 {{stripe_demo.stripe_subscriptions}} s

23 left join {{raw.stripe.subscription_item}} si on s.id = si.subscription_id

24 left join {{raw.stripe.plan}} p on si.price_id = p.id

25 left join {{raw.stripe.subscription_discount}} d on s.id = d.subscription_id

26 left join {{raw.stripe.coupon}} c on d.coupon_id = c.id

Step 3: Normalize to monthly revenue

Now let's normalize revenue to MRR and apply currency conversion. To get the monthly amount we need to divide it by the interval_count and ad interval_period. After that, we use a currency conversion table available in the Weld app as a Forex connector. You can use your own here if needed. We average the rate and group by month to join it on our main table which holds the currency for the amount. Finally, we divide by the rate.

1with

2 subscription_item as (

3 select

4 customer_id

5 , subscription_id

6 , amount_off

7 , start_date

8 , canceled_at

9 , quantity

10 , amount

11 , currency

12 , status

13 , case

14 when interval_period = 'year' then ((amount / interval_count) / 12) * quantity

15 else (amount / interval_count) * quantity

16 end monthly_amount

17 from

18 {{stripe_demo.stripe_subsription_item}}

19 where

20 deleted = 0

21 )

22 , forex as (

23 select

24 avg(rate) rate

25 , currency

26 , date_trunc(timestamp, month) month

27 from

28 {{raw.forex_eur.incremental}}

29 group by

30 month

31 , currency

32 order by

33 month

34 )

35select

36 customer_id

37 , subscription_id

38 , start_date

39 , canceled_at

40 , amount_off

41 , status

42 , case

43 when monthly_amount > 0 then monthly_amount / rate

44 end as monthly_amount_eur

45from

46 subscription_item

47 left join forex on date_trunc(start_date, month) = forex.month

48 and upper(subscription_item.currency) = forex.currency

Step 4: Identify active subscriptions and sum revenue

Now we will sum the total revenue per customer per subscription and subtract any discount applied. Additionally, we select active and canceled subscriptions separately in conjunction with a coalesce function to assess whether there is an active subscription on a given customer. We also use this to get the latest cancellation date to calculate churn in case no active subscriptions are present anymore.

Tip: It's important to note that discounts are applied on a subscription level which means that you need to make sure that you only subtract it once per subscription. We use the max function to avoid this as we joined the discount on a subscription_item level.

1with

2 revenue_per_subscription as (

3 select

4 customer_id

5 , cast(date_trunc(start_date, month) as date) start_date_month

6 , cast(date_trunc(canceled_at, month) as date) canceled_at

7 , max(amount_off) amount_off

8 , status

9 , sum(monthly_amount_eur) monthly_amount_eur

10 , sum(monthly_amount_eur) - ifnull(max(amount_off), 0) monthly_amount_eur_after_discount

11 from

12 {{stripe_demo.stripe_mrr_normalization}}

13 group by

14 customer_id

15 , start_date_month

16 , canceled_at

17 , status

18 )

19 , active_subscriptions as (

20 select

21 customer_id

22 , max(status) status

23 from

24 revenue_per_subscription

25 where

26 status <> 'canceled'

27 group by

28 customer_id

29 )

30 , cancelled_subscriptions as (

31 select

32 customer_id

33 , max(canceled_at) canceled_at

34 , max(status) status

35 from

36 revenue_per_subscription

37 where

38 status = 'canceled'

39 group by

40 customer_id

41 )

42select

43 r.customer_id

44 , coalesce(s.status, c.status) status

45 , start_date_month

46 , case

47 when coalesce(s.status, c.status) = 'canceled' then c.canceled_at

48 end as canceled_at

49 , cast(

50 round(sum(monthly_amount_eur_after_discount), 0) as int

51 ) monthly_amount_eur_after_discount

52from

53 revenue_per_subscription r

54 left join active_subscriptions s on r.customer_id = s.customer_id

55 left join cancelled_subscriptions c on r.customer_id = c.customer_idgroup by customer_id

56 , status

57 , r.status

58 , start_date_month

59 , canceled_atorder by customer_id

Step 5: Create a timeseries for each customer

To make sure we have data for all months of a given customer's lifetime we create an array with dates starting from 2021-01-01. Apply your own timeframe here as needed.

The idea here is to calculate the correct start and end dates for each customer and then calculate any changes between months in the subscription. If it's the first month we know that it's a new MRR and if it's the last month with an active subscription we know it's a churn and any changes in between will be contraction and expansion relatively. We use the row_number function to rank rows to validate the first and last month. We also remove any months not relevant before any active subscription was present or after the last churn date.

1with

2 time_series as (

3 select

4 month

5 from

6 unnest (

7 generate_date_array(

8 date_trunc('2021-01-01', month)

9 , current_date

10 , interval 1 month

11 )

12 ) as month

13 )

14 , time_series_customer as (

15 select

16 *

17 from

18 (

19 select distinct

20 (customer_id) customer_id

21 , month

22 from

23 {{stripe_demo.stripe_mrr_active_subscriptions}}

24 cross join time_series

25 order by

26 customer_id

27 , month

28 )

29 )

30 , time_series_revenue as (

31 select

32 c.customer_id

33 , month

34 , start_date_month

35 , first_value(canceled_at ignore nulls) over (

36 partition by

37 c.customer_id

38 order by

39 month asc

40 ) canceled_at

41 , monthly_amount_eur_after_discount

42 , first_value(status ignore nulls) over (

43 partition by

44 c.customer_id

45 order by

46 month asc

47 ) status

48 , last_value(monthly_amount_eur_after_discount ignore nulls) over (

49 partition by

50 c.customer_id

51 order by

52 month asc

53 ) mrr

54 from

55 time_series_customer c

56 left join {{stripe_demo.stripe_mrr_active_subscriptions}} r on c.customer_id = r.customer_id

57 and c.month = r.start_date_month

58 order by

59 customer_id

60 , month asc

61 )

62select

63 *

64 , case

65 when mrr - lag(mrr) over (

66 partition by

67 customer_id

68 order by

69 month asc

70 ) is null then mrr

71 else mrr - lag(mrr) over (

72 partition by

73 customer_id

74 order by

75 month asc

76 )

77 end mrr_change

78 , row_number() over (

79 partition by

80 customer_id

81 order by

82 month asc

83 ) mrr_rank_asc

84 , row_number() over (

85 partition by

86 customer_id

87 order by

88 month desc

89 ) mrr_rank_desc

90 , from

91 time_series_revenuewhere mrr is not null

92 and (

93 canceled_at is null

94 or month <= canceled_at

95 )

96order by

97 customer_id

98 , month asc

Step 6: Summarize MRR

Finally you are ready to sum it all up and divide MRR into the different types and calculate net new NRR. Additionally, we are adding a total to also show the total MRR over time.

1with

2 mrr_calc as (

3 select

4 *

5 , case

6 when mrr_rank_asc = 1 then mrr_change

7 else 0

8 end as new_mrr

9 , case

10 when mrr_change < 0 then mrr_change

11 else 0

12 end as contraction_mrr

13 , case

14 when mrr_change > 0

15 and mrr_rank_asc > 1 then mrr_change

16 else 0

17 end as expansion_mrr

18 , case

19 when mrr_rank_desc = 1

20 and status = 'canceled' then mrr * -1

21 else 0

22 end as churn_mrr

23 from

24 {{stripe_demo.stripe_mrr_time_series}}

25 )

26 , net_mrr_calc as (

27 select

28 month

29 , sum(new_mrr) new_mrr

30 , sum(contraction_mrr) contraction_mrr

31 , sum(churn_mrr) churn_mrr

32 , sum(expansion_mrr) expansion_mrr

33 , sum(

34 new_mrr + contraction_mrr + churn_mrr + expansion_mrr

35 ) as net_new_mrr

36 , from

37 mrr_calc

38 group by

39 month

40 )

41select

42 month

43 , new_mrr

44 , contraction_mrr

45 , churn_mrr

46 , expansion_mrr

47 , net_new_mrr

48 , sum(net_new_mrr) over (

49 order by

50 month asc

51 ) as mrr_totalfrom net_mrr_calc

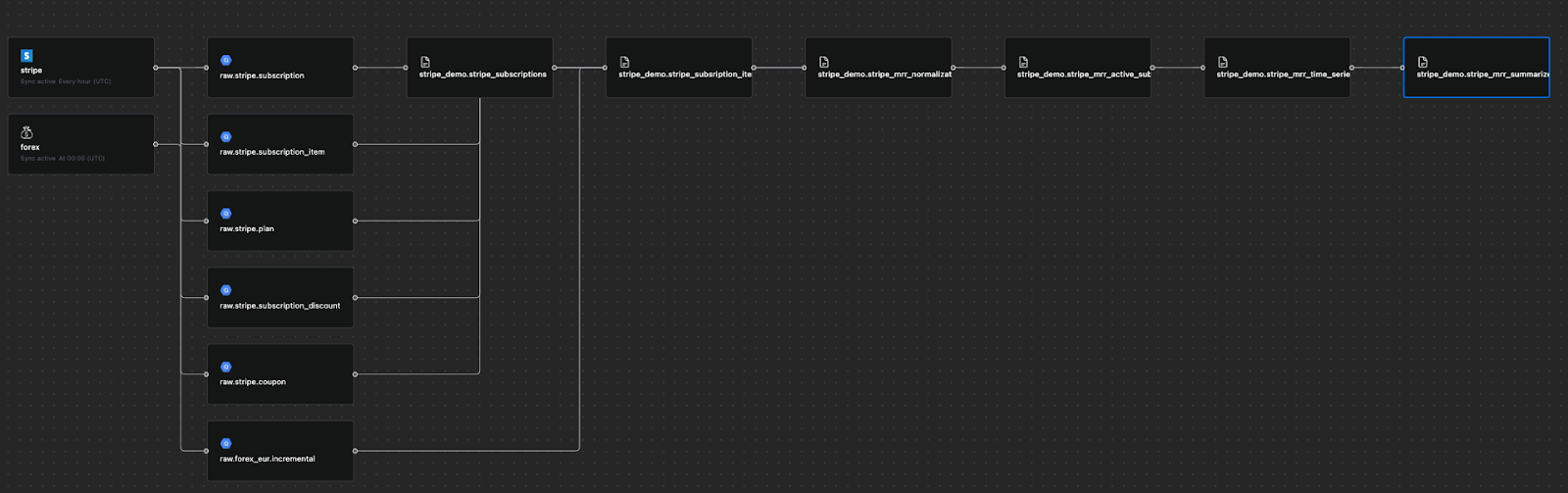

Thats it. Your model is ready and you can see the full lineage graph of the model below:

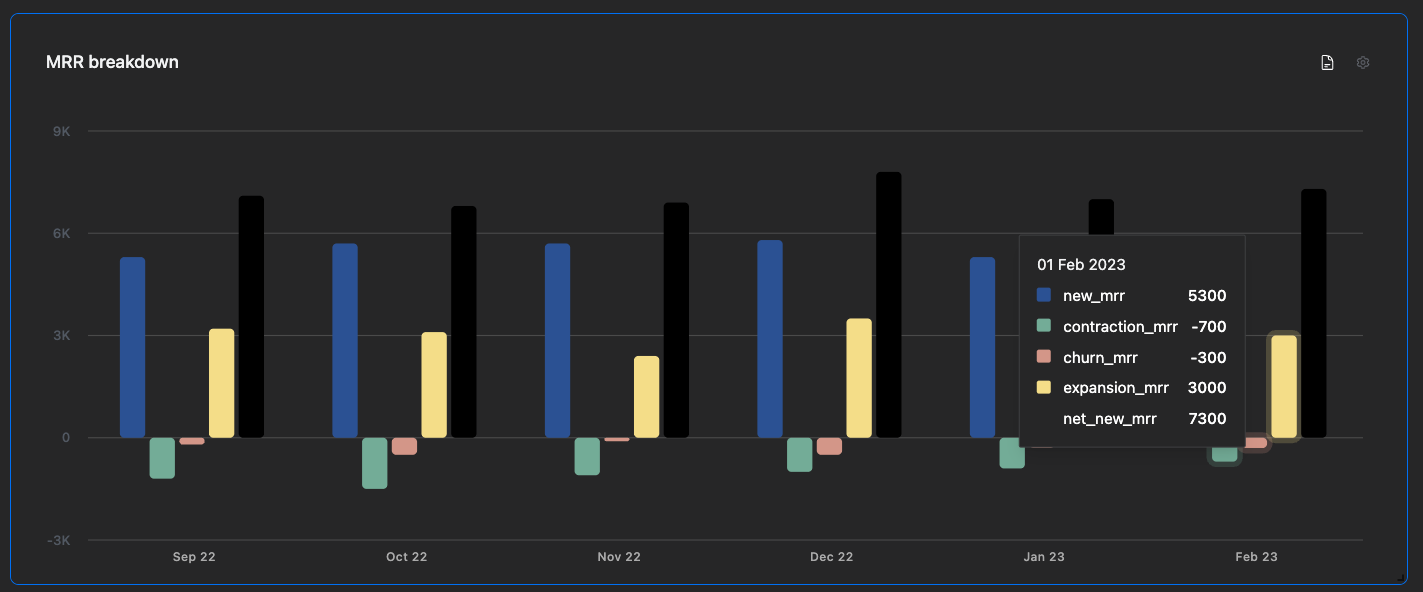

Additionally, you can visualize your MRR breakdown like the chart below:

Tip: If you want to slice and dice your data based on country, industry, company size or specific companies add those columns to your model from Step 2.

Conclusion:

Depending on your Stripe and data infrastructure set up the model that is needed can change but this should give you an idea of how it can be done.

Continue reading

New Facebook Ads Conversion Table

Analysing your Facebook Ads conversion data has now got easier with our new conversion insights table.

New Connector Alert - Qualtrics

Need better Qualtrics reporting? Weld allows you to seamlessly integrate your Qualtrics data with the rest of data sources, creating a unified view of your business metrics. Enhance your analytics and make more informed decisions with our new ETL connector!

G2 2024 Summer Reports

The G2 2024 summer reports are live and Weld has been awarded 39 badges!